So how is Abenomics doing?

Well, on the plus side, there have been two pronounced effects. The first is the aforementioned stock market rally. Here is the Topix (similar to our S&P) over the last 3 months:

And here is the yen/dollar over the same period (higher means weaker yen):

So as you can see, Abe's election has sparked a rapid depreciation of the yen (which should, theoretically, boost Japan's exports), and a rally in the Japanese stock market.

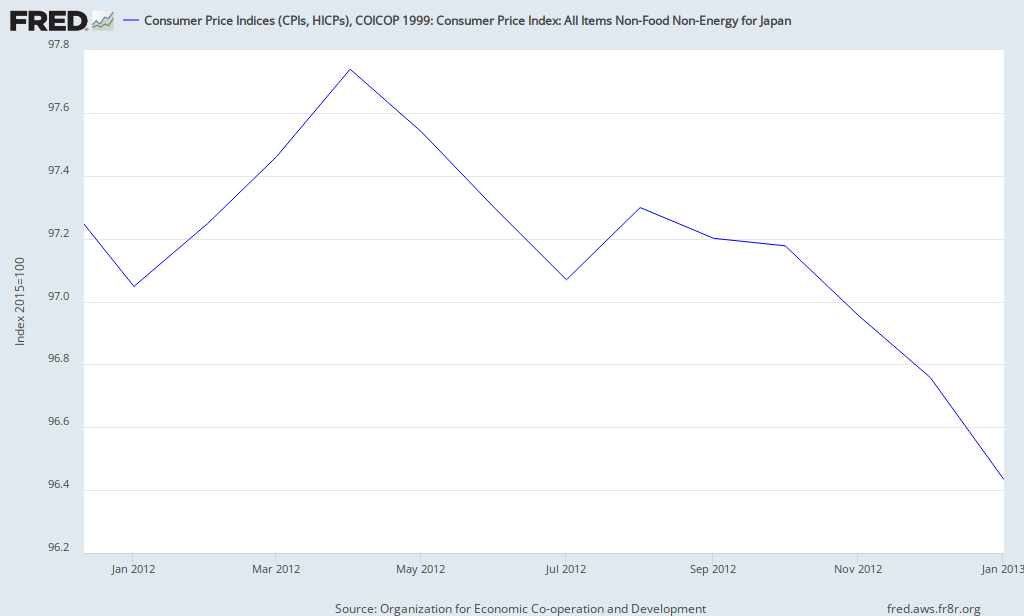

So that's the good news. Here's the bad. Since Abe's election, Japan has slipped back into deflation:

But inflation expectations, as measured by breakevens on the Japanese version of TIPS, are up - to 1%. So maybe we'll see this deflation turn around soon.

As for Japan's current account, it has continued to log a deficit, as the weak yen made imports more expensive. As for whether or not export demand will pick up...I guess we'll see. Capital expenditures by Japanese firms were still falling in December, but we'll just have to wait for more recent data.

In summary: Abe seems to have shifted a lot of people's expectations. He seems to have convinced many foreigners that Japan will print a lot of money; this has caused a fall in the yen. And those expectations of a falling yen seem to have convinced many foreigners that the weaker yen will boost the profits of Japanese companies, since foreign investors are behind Japan's stock market rally. And he has also convinced some Japanese people that deflation will soon give way to weak inflation...though these expectations have not yet translated into real inflation.

But now comes the real test. Convincing foreigners that big changes are coming to Japan is an easy trick, but it won't help Japan's economy a lot. The shift to 1% inflation expectations is more promising. But 1% is still pretty darn low.

Yet I still stand by my initial evaluation - Abe is generating a brief fillip of optimism and a sense of economic movement in order to secure an LDP majority in the all-important upcoming upper house election. Securing that majority would allow him to get on with his true all-consuming priority - revising Japan's constitution. After that, his conservative instincts, and the conservative instincts of the Finance Ministry (which is arguably a lot more powerful than the Prime Minister), will take over, as will the worries of the LDP's elderly voters that inflation would destroy their hard-earned life's savings. At that point, talk of radical monetary reform will evaporate, and the recent movements in the yen and the Japanese stock market will begin to slowly unwind.

This is a pessimistic scenario, but, like Japanese consumers' expectations of deflation, my beliefs about the effectiveness of Japan's Liberal Democratic Party are strongly anchored, and will require more than a bit of tough talk to dislodge.

Not sure if it's all an elaborate bluff...I think if Abe's smart enough to talk down the yen, he's also smart enough to use monetary policy to do it if talking down fails. The issue may not be close to heart, but it's already been a very successful political tool and helped him up to 70%+ approval, so why not run with it?

ReplyDeleteHe'll be met with political resistance for sure, but the electoral success gives him a mandate. And LDP wins in the upper house will give him *more* power to go through with it, not less.

Even retiree voters and a nervous public may not be enough to stop him, because he probably cares about what business interests want even more. And as we've seen with constitutional reform, he's more than comfortable going against the public's stated interests. The decimation of the DPJ gives him security anyway.

Yes, why assume Abe will be like the rest and abandon stimulus? Because all the rest are the same.

DeletePoliticians seem to try very hard to defend their broken austerity policies, often losing their jobs in the process and they seem give up on successful stimulus attempts just after the good news come in. Please provide me an example of the opposite.

But I still don't understand why does stimulus actually require more persistence than stimulus. The only arrogant explanation I have is that politicians don't actually look at or trust the the data.

My favorite Bulgarian proverb - "the crazy knows no rest".

DeleteSo the retiree voters have more or less locked the country in a largely deflationary set-up that benefits them and screws up everyone else? That's pretty messed up.

ReplyDeleteSee also: All other rich countries...

DeleteGreat analysis.

ReplyDeleteI was a believer (in Abe) before I read this. Now...not so much.

It's pretty worrisome, though. He seems much more preoccupied with tweaking China's nose then fixing the economy.

Stock rallies probably signal a belief that investors think market monetarism works (and that Hugo Chavez kinda sucked). But how much does it signal about economic strength? Greek stocks have steadily increased in face of a floundering economy. Of course, over a long period, stock and economic growth are pretty correlated, but not today.

ReplyDeleteAnyway... Here's to Nikkei 36000.

I don't really understand your refrain about the exchange rate. Are you saying that in a liquidity trap domestic prices won't rise to offset the exchange rate effect?

ReplyDeleteIt seems to me that the exchange rate is rising because people are expecting domestic prices to rise, in which case there wouldn't be an export boom. That's not to say that higher inflation wouldn't be expansionary though.

With regard to low inflation targets, like our 2%, I've lately started thinking of the analogy of standing really close to a very dangerous and deep pit, like just 2 feet (or 2 percent) away. It's pretty easy for a tremor or other disturbance to make you fall in, get hurt severely, and have it take a long time before you can climb out.

ReplyDeleteSo, as the cost is not that high to stand further away, like 4 or 5 feet (or percent, and that was considered a low percent not that long ago), isn't that the smart, preventative medicine, thing to do?

It's widely acknowledged how dangerous the ZLB is, yet your target is to stand super close to it, so it's easy to fall into it?

I'm a bit baffled by this. I thought the 90s was a great time economically, and I swear inflation was at least 3% in that decade. Why and when did 2% become the 11th commandment that no Central Banker shall ever cross?

Delete