1. Debt growth is necessary for GDP growth.

2. As GDP grows, debt levels become too large, leading to an economic crash.

3. Therefore, booms cause busts, through the mechanism of debt accumulation.

I'm not going to say this theory is wrong, or bad. It might be right. But I have a few problems related to this theory.

Problem 1: Misunderstanding Academia

First, a lot of people who believe a version of this theory - private economic forecasters, asset managers, econ writers, heterodox economists, and random punters from the web - get exasperated with mainstream academic macroeconomics, because they think that profs have ignored this idea. I often get told that mainstream academic macroeconomists are idiots, fools, and/or knaves by people whose basic view of the world conforms to a version of the Folk Theory.

But the charge is not quite right. Yes, the main strands of academic macro (New Keynesian and RBC theories) mostly ignored debt dynamics and assumed that recessions and booms are random. Yes, economists didn't pay nearly enough attention to finance before 2007. But a version of the Folk Theory actually did exist in mainstream macro since the 1990s. It's called the Leverage Cycle. To learn more about it, check out this survey paper by the eminent mainstream macroeconomist John Geanakoplos. Since the crisis, of course, theories like this have gained more currency and attention. There is also a huge amount of somewhat-related research that I'm not referencing here, just to keep this short, but at some point I will.

Now, some people are going to look at that paper and not understand the math. Then they're going to assume that Geanakoplos fails to grasp some concept for which they have an English term ("Endogenous money"! "Double-entry bookkeeping"! "Disequilibrium dynamics"! "Complex systems"! "Reflexivity"! "Minsky moments"! etc.). Then on that basis, they're going to continue to claim that mainstream academic macroeconomics fails to believe in the Folk Theory, and continue to call mainstream academic macroeconomists idiots. But because they don't understand Geanakoplos' math - and possibly don't even understand the precise meaning of the English terms they're throwing around - they don't actually know if Geanakoplos' math represents "endogenous money" or "complex systems" or whatever.

So you probably shouldn't listen to these people.

Problem 2: The Illusion of Knowledge

Problem 2: The Illusion of Knowledge

My second, and bigger, problem with the Folk Theory is how the theory fits the data. If you read Geanakoplos' paper you'll notice that it's heavy on ideas, light on facts, as are most of the papers in that literature. Well, if we want to actually apply the theory, that's a problem. The latest research on long-term economic forecasting shows that debt is important for predicting economic cycles. But what's important is not the amount of debt, but the quality of debt, as measured (for example) by credit spreads and junk bond shares. Previous studies have mostly found the same, which is why you see credit prices as leading indicators rather than credit levels. That means that, as far as we can tell, while debt does do interesting and potentially bad things to an economy, you probably can't predict recessions just by saying "Holy crap, this country is running up a lot of debt, they're about to crash!!"

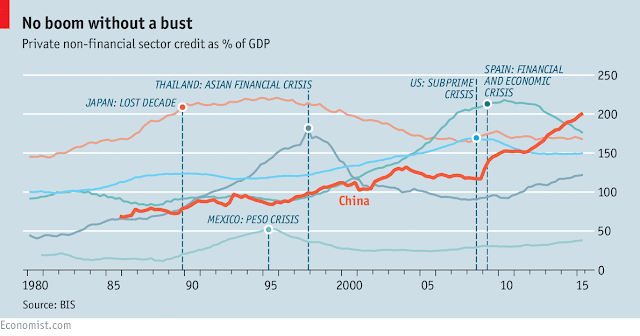

Of course, that has not deterred many in the econ media from making exactly this sort of claim, especially when it comes to China. For example, a graph in a recent piece in The Economist attempts to show that China's large increase in debt presages a coming crash:

We're supposed to see a clear pattern here. Debt rises and hits a peak, then a recession hits and debt levels collapse (deleveraging). China's debt line has recently increased a lot. Hence, we should expect it to collapse soon. It's the Folk Theory.

But this chart is actually really bad. First of all, it suffers from massive look-ahead bias. We know these countries experienced financial crises and lost decades, so of course they're included on the graph. Actually, look-ahead bias is present for China too, since we already know that its economy is now slowing dramatically, that it's experiencing financial troubles, and that its credit quality has probably deteriorated recently.

Second of all, the chart (and the Folk Theory itself) has a huge correlation-causation problem. Suppose, for the sake of argument only, that debt had nothing to do with economic cycles. Suppose it was only along for the ride - when they're more economic activity, people borrow and lend more with each other, and when growth slows down they borrow and lend less, but the activity of borrowing and lending has no effect on how much gets produced. In this hypothetical fantasy world, we'd naturally see debt levels rise most of the time, but we'd see them fall temporarily when there's an economic downturn. In other words, we'd see exactly what's on the graph above. But rising debt levels would be no cause for alarm.

In fact, if you look at that graph carefully, you may start asking questions that are very uncomfortable for the Folk Theory. Why did Thailand not have a debt crisis in 1991? At that point, debt-to-GDP had been rising strongly for over a decade. Why did Spain not have a crisis in 2000? Why did Japan reach a peak debt-to-GDP ratio of over 200% before it had a crisis, while Mexico topped out at 50%? Why didn't China have a recession in the early 2000s?

When I present adherents of the Folk Theory - usually econ writers or private-sector analysis - with these kind of questions, they typically just insist that "debt to GDP can't keep rising forever". But actually in principle, it can. I can borrow $1 million from you and lend $1 million to you, both at the same interest rate, every day, forever, without anything going wrong. Our total debt level will just keep increasing forever, with no limit.

In the real world, of course, there are all kinds of frictions that probably prevent this kind of thing from happening. But unless you understand what those frictions are, and how to measure them, you won't have a good structural theory of where debt-to-GDP levels max out. And we already know that debt levels are a poor forecaster of economic performance.

So in practice, the Folk Theory is much less useful than people believe. If you can't use a theory to make concrete predictions, what good is the theory?

Problem 3: Bad Policy Advice

But my third problem with the Folk Theory of business cycles is the biggest: I suspect that it encourages bad policy. The story the Folk Theory tells is that you can't have good economic times without increasing debt, and that increasing debt always causes a bust. So good times come at a price - you can't have prosperity today without disaster tomorrow.

That kind of story probably has deep roots in human history - it probably comes from the Malthusian Ceiling. It is also a morality tale, rooted in partial-equilibrium thinking - if you borrow and consume too much today, you will be sad when you have to pay it back. But this is a bad way to think about the overall economy, since total debt is mostly just us borrowing from and lending to ourselves. Paul Krugman has written a lot about this.

When we think of the economy as a morality play, it encourages bad policy. For example, it can lead to destructive austerity. The Folk Theory is behind silly statements like "you can't solve a debt problem with more debt." The Folk Theory also underlies the bad advice of the people Krugman calls "sado-monetarists."

The fact is, something like the Folk Theory might be operating in real life. But even if so, it is probably just one of a number of things that contribute to business cycles. And because macro data is not very informative, it will be difficult to tell how important of an effect it is. Meanwhile, the Folk Theory is exerting far too powerful an influence over the minds of the economics commentariat and (probably) the private sector.

Updates

I've (predictably) gotten a lot of pushback on this post. The biggest source has been from people who say that debt volumes actually do forecast recessions. They've sent me some evidence to this effect. Like I said, the Folk Theory might very well be right -- there's a lot of theory research, by top people, showing how it could easily be true. The question is whether the evidence so far supports it.

First, we have the papers by Jorda, Schularick, and Taylor, e.g. this one. The basic idea of these papers is that expansions that involve lots of debt are followed by deeper, longer recessions than other expansions. That doesn't help you predict the timing of a bust, but it does give you some added forecasting power for real economic variables, since it increases the likelihood of a big bust for any given likelihood of a bust. This kind of second-order effect seems much more believable, to me, than the kind of first-order story (too-high debt levels cause crashes) told in typical versions of the Folk Theory. Another example of a more complex effect of debt on growth is debt deflation. These effects stand somewhere between the Folk Theory and economic theories that ignore debt levels entirely.

But it's worth noting that the FRB forecasting study that I cited earlier conducts a "horse race" between its own price-based indicators -- junk bond shares and credit spreads -- and the Jorda, Schularick, and Taylor measures. They FRB folks find that debt levels don't add any extra forecasting power if you have standard information about debt quality. Of course, that means debt levels might be useful for forecasting if you have countries that report debt levels but not spreads (or report accurate data for levels and crappy data for spreads). But that doesn't imply the Folk Theory is right.

Another paper is this study by Mathias Drehmann of the BIS. It shows a reduced-form relationship between debt-to-GDP ratios and the risk of banking crises (which tend to cause recessions), just as the Folk Theory would predict. This study looks at multiple countries, while the FRB paper just looked at the U.S., so that adds lot of evidence; it also poses a problem, since a lot of those crises are just going to be one crisis, the global 2008 crisis, in which we know credit-to-GDP was very high (the sample starts in 1970). That's look-ahead bias -- we just came out of an episode in which we observed historically high credit-to-GDP ratios and also a huge crash. That inspired us to think "Hey, maybe the high debt levels caused the crash!" But if all we do is go back and verify that yes, high debt levels did in fact precede the crash, we haven't shown anything. I think that studies like this BIS one are in danger of this bias, so it might be good to restrict these samples to the pre-2008 period. Also, the BIS study doesn't include credit quality measures like spreads; with that additional indicator, much of the forecasting power of debt levels might disappear.

The most convincing Folk Theory paper that anyone has sent me is this one by Matthew Baron and Wei Xiong. It uses a very long historical sample of many countries, starting in 1925. The result here is that very rapid increases in bank credit give a good indicator of recessions on the way. They use a nonlinear threshold model for this. Note that this is different from the Drehmann result, which is that levels of credit forecast recessions. Also note that like others, this paper doesn't include spreads or other credit quality measures.

So to sum up:

1. The Folk Theory might or might not be right.

2. The forecasting evidence is not at all clear. The causal evidence is even less clear, as usual in macro. There is some indication that debt levels can help predict recessions, or at least recession severity, but credit quality (sentiment) measures might capture this better than debt levels.

3. More complex interactions of debt and economic activity, such as debt deflation or debt overhangs from asset bubbles, might be good alternatives to the Folk Theory.

Updates

I've (predictably) gotten a lot of pushback on this post. The biggest source has been from people who say that debt volumes actually do forecast recessions. They've sent me some evidence to this effect. Like I said, the Folk Theory might very well be right -- there's a lot of theory research, by top people, showing how it could easily be true. The question is whether the evidence so far supports it.

First, we have the papers by Jorda, Schularick, and Taylor, e.g. this one. The basic idea of these papers is that expansions that involve lots of debt are followed by deeper, longer recessions than other expansions. That doesn't help you predict the timing of a bust, but it does give you some added forecasting power for real economic variables, since it increases the likelihood of a big bust for any given likelihood of a bust. This kind of second-order effect seems much more believable, to me, than the kind of first-order story (too-high debt levels cause crashes) told in typical versions of the Folk Theory. Another example of a more complex effect of debt on growth is debt deflation. These effects stand somewhere between the Folk Theory and economic theories that ignore debt levels entirely.

But it's worth noting that the FRB forecasting study that I cited earlier conducts a "horse race" between its own price-based indicators -- junk bond shares and credit spreads -- and the Jorda, Schularick, and Taylor measures. They FRB folks find that debt levels don't add any extra forecasting power if you have standard information about debt quality. Of course, that means debt levels might be useful for forecasting if you have countries that report debt levels but not spreads (or report accurate data for levels and crappy data for spreads). But that doesn't imply the Folk Theory is right.

Another paper is this study by Mathias Drehmann of the BIS. It shows a reduced-form relationship between debt-to-GDP ratios and the risk of banking crises (which tend to cause recessions), just as the Folk Theory would predict. This study looks at multiple countries, while the FRB paper just looked at the U.S., so that adds lot of evidence; it also poses a problem, since a lot of those crises are just going to be one crisis, the global 2008 crisis, in which we know credit-to-GDP was very high (the sample starts in 1970). That's look-ahead bias -- we just came out of an episode in which we observed historically high credit-to-GDP ratios and also a huge crash. That inspired us to think "Hey, maybe the high debt levels caused the crash!" But if all we do is go back and verify that yes, high debt levels did in fact precede the crash, we haven't shown anything. I think that studies like this BIS one are in danger of this bias, so it might be good to restrict these samples to the pre-2008 period. Also, the BIS study doesn't include credit quality measures like spreads; with that additional indicator, much of the forecasting power of debt levels might disappear.

The most convincing Folk Theory paper that anyone has sent me is this one by Matthew Baron and Wei Xiong. It uses a very long historical sample of many countries, starting in 1925. The result here is that very rapid increases in bank credit give a good indicator of recessions on the way. They use a nonlinear threshold model for this. Note that this is different from the Drehmann result, which is that levels of credit forecast recessions. Also note that like others, this paper doesn't include spreads or other credit quality measures.

So to sum up:

1. The Folk Theory might or might not be right.

2. The forecasting evidence is not at all clear. The causal evidence is even less clear, as usual in macro. There is some indication that debt levels can help predict recessions, or at least recession severity, but credit quality (sentiment) measures might capture this better than debt levels.

3. More complex interactions of debt and economic activity, such as debt deflation or debt overhangs from asset bubbles, might be good alternatives to the Folk Theory.

Fantastic post. Another good mainstream paper on 'debt cycles' is of course the famous Kiyotaki–Moore model.

ReplyDeleteThanks! Yeah, definitely. Kiyotaki-Moore is a classic.

DeleteNot that I disagree with the gist of your argument, though there is plenty of more careful empirical work suggesting debt has some macroeconomic influence, but I will quibble with your characterization of the work of Geanakoplos. While he would probably accept the view of his leverage cycle work as mainstream economics, it seems somewhat odd to posit the work of John Geanakoplos as a counterpoint to work on "complex systems" or "disequilibrium dynamics" given that he is an external professor of the Santa Fe Institute, an active contributor to the literature on agent based modeling and disequilibrium complex systems, and his original work which evolved into the leverage cycle model was published in a book "The Economy as an Evolving Complex System." Just because these phrases are often used loosely to dismiss work people dislike doesn't mean they are completely lacking in meaning.

ReplyDeleteHe would also probably object to being called a macroeconomist, but that's neither here nor there.

I completely support this comment. It is on the money and clearly points to the largest problem in Noah's post.

DeleteBarkley Rosser

Even if you don't want to call Geanakoplos "mainstream", the people he cites in his survey paper that I linked to are pretty much all mainstream. Nobuhiro Kiyotaki invented New Keynesian theory, for chrissake!

DeleteAs for "complex systems", the best meaning for that term has never been pinned down - talk to the Santa Fe people and they'll tell you that. As for "disequilibrium", since economists tend to use the word "equilibrium" to refer to the solution of any system of equations, one model's disequilibrium is another model's short-run equilibrium, so the whole terminology has become meaningless.

I personally think Geanakoplos is in line for a Nobel.

Noah,

DeleteKiyotaki did important work on NK models, but crediting him with "inventing" NK theory seems a bit overdone. Akerlof, Fischer, and Stiglitz were certainly co-developers, with some of them well ahead of him as near as I can tell (also depends on what one means by "New Keynesian" theory, just as there are plenty of debates over what are complex sysems). As it is, Geanakoplos is certainly an interesting case, very respectable and thus according to a sociological definition of that therefore "mainstream," even as his idea are not precisely orthodox. But then Akerlof's work along with quite a few other Nobelists is not all that orthodox either, even as he is highly respectable.

As far as I am concerned, his leverage model is basically a more mathematically clear version of Minsky's model, if taking a different tack from your nemesis, Keen, who is not respectable. But I am not knocking Geanakoplos nor necessarily trying to label him definitively.

As someone who has written extensively on complex systems and has hung out at the SFI, let me note that the most important economist behind its founding was Ken Arrow, who is both the ultimate orthodox with general equilibrium theory, even as he is a fan of complex systems theory and some other not so orthodox ideas. He is very much a fan of Geanakoplos, so he told me.

So, this is not so straightforward.

Barkley Rosser

Actually, I think that in a model with borrowers and savers, with borrowers having a higher propensity to consume, an increase in income should cause an increase in debt levels. So, also in theory reverse causation is something to take into account.

ReplyDeleteOh, for sure.

DeleteThis is (unsurprisingly) really smart.

ReplyDeleteYou don't touch on it, but it seems to be a criticism also of the mostly debunked Rogoff-Reinhart on the determinism of debt (i.e. "Economies with a certain amount of debt are destined to grow slowly, let's make sure we have less debt here.")

Any thoughts on how to look at correlation and causation? Specifically, how much does leverage lead to a downturn vs. how much does deleveraging result from one?

Yes, Reinhart-Rogoff is not great. As for correlation vs. causation, natural experiments would help, but ultimately we're going to have to understand the mechanisms of why people borrow, and that's hard as hell. In fact, knowing how hard that is is one reason I was skeptical of the Folk Theory from the first time I heard it.

DeleteNoah's article also seems to be a warning to buying into Ray Dalio's "The Machine" (http://www.economicprinciples.org/) model as well (which, if my understanding is correct, is basically variation on the "Folk Theory").

DeleteIf you want to see how debt can become a problem, but won't lead to a crash in China, I suggest reading Michael Pettis.

ReplyDeleteAnd if you want to see the evolution of debt, see JW Mason's Fisher Dynamics in Household Debt: The Case of the United States, 1929-2011.

Delete"....When I present adherents of the Folk Theory - usually econ writers or private-sector analysis - with these kind of questions, they typically just insist that "debt to GDP can't keep rising forever". But actually in principle, it can...."

ReplyDeleteIf in principle it can , in practice it would have , many times. So I assume you can provide a list of historical examples of countries , firms or individuals who've seamlessly progressed from debt/gdp(or income) levels of 100% to 1000% to 10,000% and beyond , and many of whom are still going strong , borrowing and spending like topsy.

Can't wait to see that list.....

Marko

Go Marko!

DeleteThis also came up... https://www.bis.org/publ/qtrpdf/r_qt1603a.htm

ReplyDeleteI think there's some sense to what you're saying. Increases in private debt don't stop unless there's a particular reason for it to. Like a financial crisis, or global recession that causes consumers and investors to freak out. I'd also be interested to know what role trade deficits versus surpluses have in allowing the continuation of accelerating debt and the sustainability of it (and whether a trade deficit itself causes an acceleration of private debt). Anyways, still plenty of questions to be asked about this issue, but it's certainly one major area that macroeconomists should be focused on when analyzing the economy.

Great post. The problem is that the prescription proposed for too much debt is usually not for debt issuers to move their savings towards new equity, new capital, inventory or other physicalized forms of savings but to go towards cash which is intrinsically worthless and doesn't carry aggregate wealth into the future. Cash is just implicit claims between people in an economy without anyone having explicitly promised to fulfull these promises nor invested in the production capacity to do it. For the aggregate, accumulation of idle cash is the poorest quality form of debt.

ReplyDeleteGreat post. The problem is that the prescription proposed for too much debt is usually not for debt issuers to move their savings towards new equity, new capital, inventory or other physicalized forms of savings but to go towards cash which is intrinsically worthless and doesn't carry aggregate wealth into the future. Cash is just implicit claims between people in an economy without anyone having explicitly promised to fulfull these promises nor invested in the production capacity to do it. For the aggregate, accumulation of idle cash is the poorest quality form of debt.

ReplyDeleteHi Noah: My focus is econometrics rather than economics so most of above is greek to me. But somewhat related is the fact that in the mid-late 1920's Yule and Slutsky both showed how random series can quickly look like cycles when their moving sum is taken. So, "business cycles" could just be artificial constructs of random numbers.

ReplyDeleteDiebold et al wrote a nice book on time series and business cycles if anyone is interested in that side of it.

"Why did Japan reach a peak debt-to-GDP ratio of over 200% before it had a crisis, while Mexico topped out at 50%??"

ReplyDeleteBecause unlike Mexico, Japanese owe it to themselves.

"Why did Spain not have a crisis in 2000?"

Because they entered the European Monetary Union and have suddenly as much cheap credit as they can ask for.

"Why didn't China have a recession in the early 2000s?"

Because Folk Theory has an additional "epicycle": It is not only the pace the debt rises what matters; the "Ceiling" is also determined by the potential output growth.

Note: Reinhart-Rogoff was not a complete Folk Theory; they were looking data for a Only Public Debt Folk Theory. They failed.

But, at least they collected and looked at data.

DeleteYes, but they confused the lines in their tri-focals with properties of the data.

DeleteMore debt means more savings.

ReplyDeleteA post that once again stick to a narrative,doesn't even try to solve the narrative,debt is a equation in brackets of the whole equation,how it is created,distributed and in the end paid for isn't balanced doesn't protect true values but actually destroys them if it isn't counterbalanced,nowhere does this post tackle the fact fundamental ideology of profiteering,supply side economics with a flawed ideological tax aversion shows and means that the narrative is out of balance and therefore must alter true values and therefore predicting crashes through debt is actually quite easy,the reason that different levels of debt for various countries differ is there starting point to economic equilibrium in the first place and the size of the economy that the infrastructure in the countries of your examples shows

ReplyDeleteThe difference between the price of anything high or low and it true value is the damage it does to the economy and indiscriminate debt is one of great forces to distortion

"I can borrow $1 million from you and lend $1 million to you, both at the same interest rate, every day, forever, without anything going wrong. Our total debt level will just keep increasing forever, with no limit."

ReplyDeletenah

Funny. The spreadsheet I have pretty much shows Debt / GDP tops out at 90%. Excel can't be wrong.

ReplyDeleteIs this an example of straw man fallicy of logic?

ReplyDeleteNow, some people are going to look at that paper and not understand the math. Then they're going to assume that Geanakoplos fails to grasp some concept for which they have an English term ("Endogenous money"! "Double-entry bookkeeping"! "Disequilibrium dynamics"! "Complex systems"! "Reflexivity"! "Minsky moments"! etc.). Then on that basis, they're going to continue to claim that mainstream academic macroeconomics fails to believe in the Folk Theory, and continue to call mainstream academic macroeconomists idiots. But because they don't understand Geanakoplos' math - and possibly don't even understand the precise meaning of the English terms they're throwing around - they don't actually know if Geanakoplos' math represents "endogenous money" or "complex systems" or whatever.

So you probably shouldn't listen to these people.

Yes, although strictly speaking it isn't a *logical fallacy* to attack a straw man. There's also more than a hint of ignoratio elenchi here.

DeleteI found Noah's opinion unconvincing.

ReplyDeleteThe Geanakoplos paper--written by a fellow Greek or Greek surnamed individual-- is not difficult to follow, contrary to Smith's assertion (and I'm not a math major). The paper:

Geanakoplos Abstract: "Equilibrium determines leverage, not just interest rates. Variations in lever-age cause flucutuations in asset prices. This leverage cycle can be damaging to the economy, and should be regulated" - this is exactly the new book by Adair Turner, a UK hotshot in finance, "Between Debt and the Devil".

The Geanakoplos paper uses "representative agents" (plural, not singular) to support a boom / bust cycle. In the first, simple example, with only two states (that the author concedes is simplistic), it assumes only rising prices and no short selling. The calculus is just for show, for his fellow economist readers. Geanakoplos attempts to guide his reader through the math with examples, even humorous examples ("Wouldn't he love to be able to borrow more, even at a slightly higher interest rate? The answer is no!")

The example given in the first 24 pages is simplistic and by no means representative of a real economy. As such, it's just an academic exercise. The conclusions are somewhat banal: (pg. 26--giving higher collateral or margin requirements on new loans--which the author calls as the inverse of 'leverage'--will affect all outstanding loans. So obvious and trite)

The paper throws around terms like "Arrow-Debreu equilibrium" and assumes this model describes an actual economy, when in fact it's not, but a highly stylized economy (for one thing, it assumes a continuous distribution of prices, which no real economy has).

All in all, N. Smith failed in his thesis to explain that economists "saw it coming". Even the Geanakoplos paper was written post 2008.

Finally, Smith himself tries to give an occult meaning to his posts by a neologism: "to what I call the Folk Theory". Is there any reason to coin words other than vanity?

"But unless you understand what those frictions are, and how to measure them, you won't have a good STRUCTURAL theory of where debt-to-GDP levels max out."

ReplyDeleteha! good one

This comment has been removed by the author.

ReplyDeleteFirst of all, you have the wrong graph. Post Keynesians tend to look at the rate of change of growth, because of endogenous money. Endogenous money means that banks are creating money, and when they do so, they are increasing the total demand in the economy, which is to say that they are injecting more spent money directly into the economy. The principle of the loan is the newly created money, while the interest on the loan is not because it is the bank's wages which are spent back into the economy. Repayment of actual loan principle destroys the money that the bank created.

ReplyDeleteThe created money being spent into the economy is what creates the boom. In other words, if the rising amount of loan principle is increasing relative to the principle repayment, then we have a net increase in total spending.

Which brings me to the second point, "But this is a bad way to think about the overall economy, since total debt is mostly just us borrowing from and lending to ourselves." This is inherently a false statement. Banks do not lend deposits. If a bank has $100m of depositor money, and then it lends $90m, it does not have $10m left in the vault. All depositors still have their money, and can withdraw it or transfer it to another bank at any time. To say otherwise would mean that you as a depositor might go the bank someday and see your $1000 balance has gone to $100 because the bank loaned 90% of it. It just isn't true. Banks are not intermediaries charging fees. If they were, the interest rate charged to customers would have to be much higher than 4% because the depositors would have to be compensated for their higher risk.

The bust is a reaction function of either public or private institutions. If banks continue to lend money with a net positive principle to repayment rate, then the boom continues. When they stop (as a reaction to the lack of worthy borrows), then the dance is over. The public sector can augment with fiscal deficit spending, of course, but it has to make up for the shortfall to have any effect.

So, I have no clue as to where your three ideas of "Folk Theory" came from, because they should read like this:

1. Rising demand is necessary for GDP growth.

2. Rising demand comes (generally) from endogenous money creation by banks or fiscal deficit spending by government.

3. This boom causes the bust as principle repayments become larger than principle loans.

This comment has been removed by the author.

ReplyDeleteRather than Debt-to-GDP, spend some time with private or total Debt relative to circulating money.

ReplyDeleteThe way to read the debt-per-dollar ratio is this: It goes up until there is a big economic problem, it goes down while that problem is being solved, and it goes up again after the problem is solved. It is important to note that when the downtrend ends and the uptrend begins, the economy for a while is very, very good.

Maybe not useful for predicting the business cycle, but useful for understand the economy and the problem of debt.

At least in the US, household sector spending Granger causes household sector borrowing, but household sector borrowing does not Granger cause household sector spending.

ReplyDeletehttps://thefaintofheart.wordpress.com/2014/06/14/does-lending-cause-nominal-spending-or-does-nominal-spending-cause-lending/

Thus Folk Theory is not supported by empirical reality.

Your empirical reality doesn't prove anything. It just proves what you wanted it to prove. Endogenous money theorists don't say household spending is always preceded by borrowing. They say that household sector borrowing and private investment are SOMETIMES financed by borrowing.

DeleteWhy do people criticize things they clearly have no understanding of?

Impressive. You've proved you have no understanding of heterodox economics in two consecutive posts.

ReplyDeleteThe best part of this post is that you discuss the quality of credit to prove your point which is exactly what Hyman Minsky's Financial Instability Hypothesis says. In other words, you used the theory you're criticizing to prove it wrong.

Your occult heterodox methodology of actually reading what people write to find out what they believe has no place here.

DeleteYou must stick to the orthodox methodology of imagining what somebody like Minsky *might* believe, on the assumption that he is an idiot (after all, he's not a mainstream economist), ascribing it to him and others like him, and finally ignoring all attempts to clarify the position or explain what people's actual beliefs are.

Despite the use of the technical term "Minsky moment" in the original post, Noah is clearly not writing about Minsky. Minsky distinguished between hedge, speculative, and Ponzi finance, that is, three different kinds of debt. (I forget whether he also distinguished between private and public debt, another dimension clearly of importance to those specialists who develop theories of endogenous money.) And Noah assures us that those unnamed and unnameable folks he pretends to be talking about do not understand that "what's important is not the amount of debt, but the quality of debt".

DeleteRobert,

DeleteMinsky was a heterodox economist whose model of the economy focused exactly on the things Noah is criticizing here. My guess is that Steve Keen and his followers are the target of this post and Keen is a Minskyan.

Regardless, Noah's post has some pretty comical mistakes in it. Aside from using a Minskyan concept to "debunk" Minskyan thinking, Noah's call to authority citing Krugman is humorous considering Krugman has no clue how banks work. Krugman once said banks don't create demand out of thin air when they expand their balance sheets. In other words, Krugman is a confirmed zero when it comes to knowing how bank balance sheet expansion and endogenous money works. Citing Krugman, an international trade economist, as an expert on debt is like citing Noah Smith as an expert in heterodox economics.

I think Professor Keen must have run over Noah's cat or something. Every once in a while he rolls out a couple of these type of troll pieces, slinks back to his cave thinking his work is done until the facts break his latest 'debunking'.

Deleteaxdouglas: "the orthodox methodology of imagining what somebody like Minsky *might* believe, on the assumption that he is an idiot"

DeleteI can't say how true that is or not, but that's a good zinger. ;)

Also the statement that "what's important is not the amount of debt, but the quality of debt" doesn't do justice to the key point Minsky made, which is that periods of extended, modest, sustainable debt growth lead to a relaxation of underwriting standards and an excess of optimism. Thus good quality debt gives way to bad quality debt. That's the real reason behind the Folk Theory's worry about growing debt levels - not, as is condescendingly supposed in this blog post, a naive belief that debt growth is inherently unsustainable.

ReplyDelete"... the Folk Theory itself ... has a huge correlation-causation problem."

ReplyDeleteFor those of us too lazy to comb through the Lopez-Salido/Stein/Zakrajsek paper in detail, what is the capsule explanation of why this objection does not apply to the quality of debt theory? The abstract is very carefully worded - "elevated credit-market sentiment in year t − 2 is associated with a decline in economic activity in years t through t+2" - but the introduction and conclusion throw caution to the winds and speak of creating risks and driving the business cycle.

But under the author's assumption of exogeneity of credit spreads joined to the basic assumption that credit in some way promotes economic activity, isn't the "Folk null hypothesis" that the observed data is expected under regression to mean?

So by folk theory you mean the idea that the level of debt predicts a collapse. I don't think there's nothing to this theory, but it is most likely just a correlation to the quality of debt that is more important. Large, fast rises in overall debt are most likely correlated to a deteriorating QUALITY of debt.

ReplyDeleteIt isn't hard to reason through this given the history of government deficits and surpluses and busts. A bust always follows a period of relatively low govenment deficit or a surplus. Government is historically the only entity that can provide a rock-solid safe bond investment. When it runs a surplus, there is a shortage of safe investments and so as long as the economy is growing, those investments start to chase higher risk, lower quality bonds and other investments.

As long as the economy is growing. But when it stops growing, that shift to higher risk, lower quality investments suddenly looks different to everyone. And from there the obvious reactions take place.

It is sufficient to say that the amount of debt doesn't necessarily reflect the quality of debt, but sometimes it does. And the quality of debt often depends upon growth rates.

I wouldn't expect market spreads to be truly indicative of the quality of debt. They are probably somewhat correlated, but only somewhat. They certainly provide material for mathematical analysis, but the absence of hard data and mathematical analysis is not reason to reject a theory. If anything this is the biggest mistake economics makes -- believing that the more something is mathematically describable the more likely it is true.

I'm encouraged that you believe in the studies that make the most sense. In your update, you said exactly what I said, that rapid rises in debt are indicative of a coming bust.

ReplyDeleteThis is the most promising idea here. The question at hand is the market spreads. Market spreads are an indication that the markets know something, not that they don't know something.

So market spreads, the main source of mathematical data, are not indicative of real values.

I think you have arrived at a good place. I believe good economic analysis is as much about acknowledging the limits of analysis as it is about innovating new analyses.

There is another Folk Theory, one which adults told me when I was young: It is not that debt levels, per se, become too large, it is that leverage becomes too large. IOW, private, speculative debt becomes too large, not that government debt becomes too large.

ReplyDeleteThis folk theory does not suggest austerity, it suggests countercyclical policy, particularly "taking away the punch bowl" in times of speculative excess. That's not austerity.

Your criticisms of the "folk theory" are certainly valid. That said, when I read mainstream economics commentary such as this blog it has often struck me that the theories all seem based on models of an economy rooted in manufacturing and international trade, while my understanding is that most companies are, in fact, in the financing business. One might even write something like:

ReplyDeleteA lot of people seem to subscribe to what I call the “main strands of academic macro (New Keynsian and RBC theories)” Theory. Roughly speaking, this is the idea that debt dynamics are not relevant when modeling recessions and booms.

I’m not going to say this theory is wrong, or bad. It might be right. But I have a few problems related to this theory.

(I'm teasing, a bit, but would suggest that there does seem to be a lack of rigor in mainstream economics in regard to the role of financing and debt)

So I flipped through the Geanakoplos paper. I'm not advocating for (or against) any particular theory, and I certainly don't claim to know the answer to the boom and bust cycle. Further, I've read the Rodrik book, and I understand that models are supposed to be simple. That said, while a simplified model of financing might be OK when modeling exchange rates, say, the way Geanakoplos characterizes the financing model doesn't seem nearly robust enough to make predictions about financing itself. I'm not saying he's "wrong" - but arguing that on a purely logical basis, even if every claim he makes is absolutely correct on its own terms, his model is so over-simplified as to have no bearing on the real world.

ReplyDeleteThe biggest failure of his model is it doesn't account for the most significant aspect of financing - the exchange of a lump sum in return for a series of future payments. He prices loans as if they're houses - but loans aren't houses. A house is worth what someone's willing to pay for it. A loan is worth the present value of its remaining payments. In his examples, Geanakoplos basically redefines a "mortgage" so that it becomes equivalent to a "house." I don't think that's valid - but even if it is, in my opinion you can't simply assert it in your assumptions you have to actually prove that you're making a valid equivalence, that your model still works.

One of the nice things about science is while you may need to be a genius to create the theory, it doesn't require an equivalent genius to disprove it if it's wrong - so I'm not claiming I can do better, I'm just saying that what Geanakoplos describes is not, in fact, how loans actually work, and thus I challenge his conclusions.

Just an update - I have no doubt that Geanakoplos understands how loans really work, undoubtedly better than I do - it's just not in the paper.

Delete